1332 Waivers Under Review at CMS

In This Issue

1332 Waivers Under Review at CMS

By Joel S. Ario, Managing Director

The Trump administration has approved one 1332 waiver to date, but four more are pending, including a sweeping Iowa waiver. Here is where things stand today:

- Alaska’s reinsurance waiver was approved on July 11, providing the state with $323 million over five years in federal pass-through funding. The federal funding equals what the federal government expects to save in reduced tax subsidies as a result of Alaska’s reinsurance program, which reduced Affordable Care Act (ACA) premiums by 35% in 2017 and is projected to stabilize premiums long term.

- Three other states have filed similar reinsurance waivers seeking federal pass-through funding. Minnesota’s and Oklahoma’s waivers have been found “complete” by the Centers for Medicare & Medicaid Services (CMS) and could be approved any day. Oregon’s reinsurance waiver was filed August 31 and is still undergoing a completeness review.

- Iowa filed an updated version of its waiver on August 22, asking for “emergency relief” to eliminate its Marketplace and fundamentally restructure individual market benefits and subsidies in addition to establishing a state reinsurance program. The Iowa waiver differs from the other 1332 submissions focused on reinsurance, which the administration has already signaled interest in approving. It is still undergoing a completeness review, and because it proposes broad and significant waivers of the ACA, is being closely watched for what it might signal about how the Trump administration will apply 1332 guidance with respect to the four guardrails designed to protect consumers and federal funds. These guardrails include:

a) Scope of coverage. The waiver must provide coverage to at least the same number of people.

b) Comprehensive coverage. The waiver must require coverage that is at least as “comprehensive” as coverage offered through the Marketplace.

c) Affordability. The waiver must provide “coverage and cost-sharing protections against excessive out-of-pocket” spending.

d) Deficit neutrality. The waiver must not increase the federal deficit.

The Iowa waiver. The Iowa waiver would eliminate the ACA Marketplace and cost-sharing reduction (CSR) payments, replace its premium tax credits with a new state-administered tax credit, and create a state reinsurance program. The waiver would replace the current metal level choices (bronze, silver, gold, platinum) with a single state-defined silver plan and no cost-sharing reductions, which would be the only plan offered in the state’s individual market for 2018 and could only be purchased directly from insurers, agents or brokers in the off-exchange market. The plan would be compliant with federal essential health benefits (EHBs), with no annual or lifetime limits.

Iowa acknowledges that its “stopgap measure” may not comply with all the requirements for 1332 waivers but cites the potential for a “collapsing commercial individual health insurance market” as a rationale for the federal government to grant temporary relief for a one-year period. The filing emphasizes that Iowa’s individual market is uniquely dominated by a non-ACA-compliant sector that is larger than the ACA-compliant sector, and therefore the 56% average rate increase sought by Medica, the one remaining statewide insurer, would make coverage unaffordable for more people than it would in a state where a larger percentage of the population has ACA-compliant coverage that is eligible for tax credits to offset the increased premiums. Wellmark BlueCross BlueShield, which provides most of the noncompliant coverage, has announced that it would return to the individual market for 2018 if the plan is approved in a timely fashion. See the graphics and analysis at the conclusion of this summary for a closer look at how the large noncompliant population complicates Iowa’s challenges.

The Iowa waiver raises challenging issues substantively and procedurally, particularly with respect to the coverage and affordability guardrails:

- Scope of Coverage. The actuarial analysis finds a coverage loss in the unsubsidized population in all scenarios, but the decline is less in the waiver scenario than if Medica plans, loaded with a 56% rate increase, become the only available option. Surprisingly, the analysis finds no coverage losses from eliminating CSRs while sharply increasing deductibles for lower-income enrollees. Notably, the latter finding conflicts with the Congressional Budget Office (CBO) analysis of the Senate’s Better Care Reconciliation Act, which found a large drop in coverage for low-income enrollees confronted with high deductibles under that plan.

- Affordability of Coverage. The state premium tax credits would be age and income adjusted and would generally favor younger and higher-income individuals as compared with the ACA, with the goal of dramatically lowering premium costs for the currently unsubsidized population. This would be accomplished by eliminating CSRs and increasing cost-sharing under the standardized plan, to a $7,350 deductible per individual and $14,700 per family.1 Although certain office visits and other nonhospital services would have limited copayments, cost-sharing would be substantially less affordable for low-income enrollees who currently receive cost-sharing reductions. The Iowa proposal presents challenging affordability issues since it increases premiums and cost-sharing for some populations, especially older and lower-income enrollees, while providing more assistance to younger and higher-income enrollees, relative to the current ACA subsidies. How the winners and losers balance out, what the overall impact is on premiums, and whether there should be one aggregate assessment or separate consideration of vulnerable populations, as required by current guidance, will be hotly debated.

While Department of Health and Human Services (HHS) Secretary Tom Price has previously praised Iowa for its innovative approach, the breadth of issues that are raised by the Iowa proposal means that there is sure to be controversy, and likely to be legal challenges if the proposal is approved, especially on an expedited timeline. The one thing that can be said with certainty is that we will learn more about the Trump administration’s approach to 1332 waivers by watching how it handles the Iowa proposal.

A Closer Look at Iowa’s Individual Market

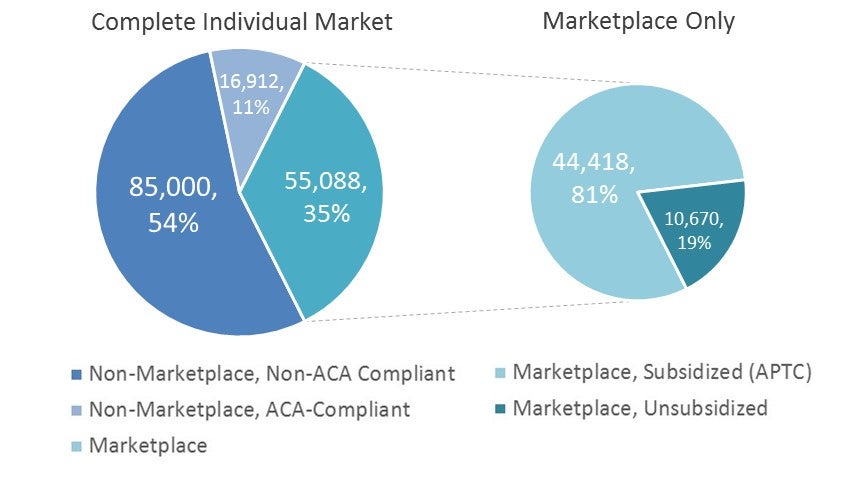

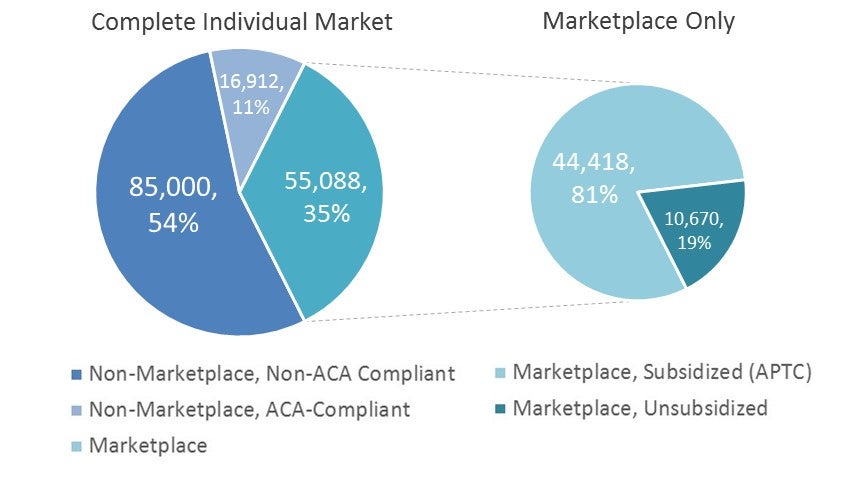

Figure 1: Iowa Individual Market Enrollment (2016, est.)2

Figure 2: Iowa Marketplace Enrollment (2015–17) and Enrollment Demographics Compared With the State (2017)3

Thanks to Kevin McAvey, senior manager of Manatt Health, for providing the analytics for Figures 1 and 2.

A majority of Iowa’s individual market enrollees in 2016 (85,000 of 157,000) remained in non-ACA compliant plans (see Figure 1). The Iowa Marketplace has captured more than 75% of the population in ACA-compliant plans (55,000 of 72,000); but as illustrated in Figure 2, the Marketplace population is much older and lower income than the Iowa population as a whole. This is not surprising since those who choose to retain their pre-ACA policies will be the younger and healthier population that could pass medical underwriting and obtain cheaper and less comprehensive policies as allowed in most states before ACA regulations took effect. Many states allowed transitional policies (those purchased between 2010 and 2013) to be renewed in 2014, but a combination of state actions and insurer choices to discontinue non-compliant products have reduced this population over time so that Marketplace populations are larger and more balanced risk pools today. Iowa’s large transitional population is unique and is partially responsible for Iowa’s anticipated high premiums and low insurer participation in 2018. The continued availability of non-compliant plans has resulted in a Marketplace risk pool that is older and sicker than originally anticipated, contributing to higher costs and ultimately higher premiums and insurer exits.

1Nationally, the average silver plan deductible in 2017 was $3,572 for a family and $7,474 for a family. The average deductible for a low-income individual eligible for cost-sharing reductions was $800.

2ACA/Non-ACA plan enrollee counts per State’s Waiver; combined with Marketplace enrollee counts per Manatt analysis of CMS Health Insurance Marketplace Open Enrollment Period Count-Level Public Use Files; effectuated (premiums paid) enrollment lower.

3Marketplace enrollee counts per Manatt analysis of CMS Health Insurance Marketplace Open Enrollment Period Count-Level Public Use Files. State counts per Manatt analysis of ACS 1-year estimates for age (2017), and 5-year estimates for gender and FPL (2011–15).

CMS Innovation Center

By Adam Finkelstein, Counsel | Edith Coakley Stowe, Senior Manager

The Center for Medicare & Medicaid Innovation (CMMI) is beginning to set its policy agenda in the new administration.

Created under the Affordable Care Act (ACA), CMMI is designed to allow the Centers for Medicare & Medicaid Services (CMS) to test innovative payment and service delivery models in Medicare, Medicaid and the Children’s Health Insurance Program (CHIP). Despite this provenance, Congress did not press for a repeal of CMMI’s authority during this year’s failed ACA repeal-and-replace debate. Instead, for now, the administration and Congress appear content to preserve CMMI as a lever for advancing their own priorities in government-sponsored healthcare.

Thus far, CMMI’s activities signal that these priorities include more provider-friendly approaches, such as voluntary tests and programs that qualify providers for Medicare bonuses, and a focus on and interest in value-based contracting for high-cost drugs. More activity is expected this year that could reveal other priorities.

Voluntary Model Tests

CMMI’s mandatory bundled payment initiatives have been a target of criticism from providers, some of whom feel they are administratively burdensome or financially disadvantageous. The key argument in favor of mandatory bundled payments is that voluntary bundled payments will not generate enough evidence to support scaling. Voluntary testing of bundles is taking place on a limited scale, but—more importantly—is likely to include selection bias, since participants are likely to opt in only if they predict more favorable financial outcomes than under fee for service. The random assignment in the design of the mandatory tests eliminates this problem.

However, CMMI is now responding to the criticism by cancelling or scaling back mandatory tests. At the close of the previous administration, CMS finalized rules to launch the Episode Payment Models (EPMs) and Cardiac Rehabilitation (CR) incentive model and to broaden its Comprehensive Care for Joint Replacement (CJR) model. Each of these was designed to build on prior CMS bundled payment initiatives by testing the use of a single, comprehensive payment for episodes of heart attack care, bypass surgery, hip fractures and femur fractures. While those past initiatives were voluntary, and relied on providers to opt in to the new payment structure, the EPM, CR and revised CJR model tests were each intended to be made mandatory, and require all providers within specific geographic areas to accept the new payment methodologies.

At the time of their adoption, one of the strongest critics of the mandatory bundled payment models was then-Representative, now-Department of Health and Human Services (HHS) Secretary Tom Price, who wrote CMS claiming that mandatory models (particularly the previously cancelled model for Part B drug payment) were not only misguided, but placed quality of care at risk and were outside of CMMI’s statutory authority. Not surprisingly, CMS is now proposing the cancellation of the mandatory EPM and CR models, and reversion of the CJR test to a voluntary approach by allowing a provider opt-out. In so doing, CMS cited “concern that engaging in large mandatory episode payment model efforts at this time may impede our ability to engage providers, such as hospitals, in future voluntary efforts.”

Launching Advanced Alternative Payment Models and Promoting Their Provider Bonuses

CMMI is also actively working to advance another current priority for CMS: designing model tests that promote physician participation in Advanced Alternative Payment Models (A-APM). Under the Medicare Quality Payment Program, providers participating in an A-APM are rewarded with a 5% Part B payment bonus, among other advantages. As might be expected, providers are clamoring for CMMI to create more model tests that meet statutory criteria for an A-APM so that they might participate.

CMMI appears willing to meet the demand for more A-APM opportunities. For example, in its proposal to scale back the CJR rule, CMS created an administrative mechanism to allow more physicians affiliated with a CJR participant to earn A-APM credit. In addition, CMS has solicited comments and is considering how it could use CMMI’s waiver and model test authority to give providers A-APM credit for A-APM payments made in Medicare Advantage. The federal government has also begun publicly responding to A-APM suggestions submitted through its Physician-Focused Payment Model Technical Advisory Committee. Secretary Price rejected two but favorably commented on an episode-based payment model submitted by the American College of Surgeons, and asked CMS to continue work on the project.

Value-Based Contracting for Drugs

Other activities have signaled an interest at CMMI in addressing the rising costs of prescription drugs by encouraging value-based contracting. When Novartis obtained approval for Kymriah, the first gene therapy available in the United States, the company hinted at a coming value-based payment arrangement with CMS. The agency issued its own press release affirming CMS’s commitment to developing payment models for drugs, announcing forthcoming guidance on submission of other value-based pricing proposals to CMS, and affirming a commitment to use CMMI to “identify and alleviate regulatory barriers in Medicare and Medicaid as may be necessary to test payment and service delivery models that involve value-based payment arrangements.”

More Activity Will Shed Light on CMMI Priorities

There is still considerable ambiguity in the direction CMMI will take in the coming years. More activity from CMMI may further clarify the policy agenda. CMS is expected to release a request for information (RFI) soon to solicit new ideas for program improvements from CMMI. The specific questions asked in that RFI should shine further light on CMMI’s policy priorities and specific goals, particularly in other areas that might be of focus to the current administration, such as model tests in Medicare Advantage or Part D. A recent behavioral health summit hosted by CMMI may also yield ideas for a model test for beneficiaries with behavioral health conditions.

In addition, Patrick Conway, CMMI’s current director, will leave CMS at the end of this week. His successor, once named, will have further opportunity to set CMMI’s objectives for the coming years, and could reshape its portfolio by scaling back current model tests and launching new ones. The cancellation of the EPM and CR models not only serves to reinforce the new CMMI approach favoring voluntary model tests but also frees up budget and staff for new models that might be in the pipeline. CMMI has also cancelled a branch of its Accountable Health Communities model test that saw little public interest, and based on that action might be expected to pare down its portfolio further to free up resources for new initiatives.