The Evolving Global Theatrical Stage

Movies may be the United States’ most powerful export. The U.S. is still the leading film market by box office revenue worldwide. From the early 20th century to the turn of the 21st, Hollywood films represented the majority of global box office receipts. It has influenced and inspired the development of filmed entertainment worldwide.

Leading film markets by 2016 box office revenue

Leading film markets by 2016 box office revenue

Source: IHS Screen Digest 2016

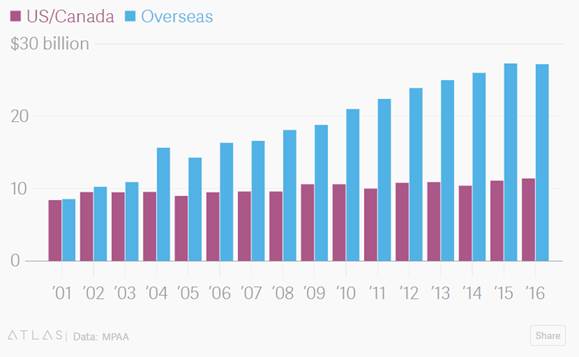

Today, with changing consumer behaviors at home and a saturated domestic market, Hollywood continues to grow ever more dependent on international screens. Eastern Asia and Latin America box offices have grown by $6B and North America’s grew $1B from 2010 through 2015. In the domestic market, attendance has grown stagnant, with 2017 summer theater attendance almost hitting a 25-year low. Mobile, streaming, and digital technologies are creating a wider range of entertainment alternatives, driving new consumption habits and also enabling piracy. While the industry is exploring solutions and more engaging experiences in the U.S., it is also increasingly catering to international markets to make up for the fading attendance. Hollywood’s revenue from international box offices has exploded in recent years, much of which can be attributed to the accessibility of information and the scale of organic and paid marketing through the web and social media. Released in the summer, The Mummy, for example, grossed $80M domestically and $329M worldwide.

Annual box-office revenue – U.S./Canada vs Overseas

Annual box-office revenue – U.S./Canada vs Overseas

Source: MPAA via The Atlas

Focusing on global mass appeal, Hollywood is making fewer movies and spending more on potential blockbusters—action and comic-thrillers and movies based on existing, popular IP. While this strategy continues to show some success at home, with movies like Wonder Woman and Spider-Man: Homecoming, there are signs of “franchise fatigue” as U.S. consumers demonstrate stronger interest in deeper and more culturally relevant storytelling (Wonder Woman falls into both categories). In 2017, Transformers: The Last Knight underperformed in the U.S., while lower-budget films Get Out and Moonlight surpassed expectations. A balanced portfolio of both global blockbusters and localized storytelling, in addition to continuous improvements in user experience, can help fill the seats in a time of many distractions.

We can’t talk about the global stage without talking about China, perhaps the most significant outside influence on Hollywood and its creative decisions. In recent years, China has invested heavily in growing its entertainment market and therefore its “soft power” at home and around the world. In 2012, it surpassed Japan to become the second-largest film market by box office revenues, and it has seen double-digit growth since, with the exception of a stark slowdown in 2016. China has poured billions into Hollywood, including Perfect World Pictures and Universal’s $500M slate financing deal. Inevitably, regulatory restrictions and uncertainties with changes both in China and U.S. leadership have slowed the flow of capital. Early this year, multiple big-ticket deals have failed to close, including Dalian Wanda’s $1B acquisition of Dick Clark Productions and Shanghai Film Group, and Huahua Media’s $1B financing deal with Paramount Pictures. Despite these recent events, the China–Hollywood ties have not completely dissolved and will continue to grow as Hollywood IP continues to attract audiences and investors and as the Chinese consumers’ appetite for movies continues to grow.

After the U.S. and China, global box office revenues are less concentrated with Japan, India, and the United Kingdom at the top. In Japan, Netflix’s and Amazon’s arrival has been a boon for content creators who have struggled to fund original productions. Japan’s animation market is booming, growing 10% and surpassing $17B for the first time in 2016. With China and South Korea’s growing film and TV presence in the region, the Japanese government has created incentives to increase movie exports and overseas collaborations. India is also a growing market. The country releases over 1,000 movies a year and is expected to double its 2015 revenues of $1.6B by 2020. The Bollywood movie Dangal beat out Marvel Studios’ Guardians of the Galaxy in China to become the second highest grossing film in the country, only after Transformers: The Last Knight. As film markets continue to develop in the area and cross-region collaboration increases, Hollywood will see more players in the ring vying for one of the most important movie markets in the world.