Growth of Digital—Home and Abroad

- Introduction

- L.A.’s Media and Commerce Tech Startup Ecosystem

- Save the Date: Made in L.A. event on March 6, 2017

- The Digital Content Market in Mexico

Introduction

By Jordan Pritchett

If there is one truism in the world of digital media, it is the simple fact that our technology and consumption habits are evolving in tandem with one another and at an exponential rate. This compounding effect of innovation is largely what makes this industry such a fascinating field to examine and discuss. We have stated this before but really can’t emphasize it enough; disruption is no longer some blue moon occurrence, but rather a normative and pervading force that is continually catalyzing market opportunities.

However, it is important to remember that disruption stems from a variety of localities. In the context of the tech/digital startup scene, Silicon Valley is still without question the first destination that comes to people’s minds. And while it certainly exists as a primary hub and has played an important role in putting the United States at the forefront of innovation, there are a number of other burgeoning hotspots. In the first piece of our monthly newsletter we hear from Mary Ermitanio who highlights our home city of Los Angeles and its growing role within the digital startup ecosystem.

Furthermore, while the U.S. remains the largest market for absolute dollar growth, a shift is underway. PwC’s Global Media Outlook (2016–2020) recently found that, in the majority of developing markets, entertainment and media spending is growing more rapidly than their respective economies at large. This is due in part to their demographic makeups, which contain sizeable youth populations. These consumers are digitally fluent, technology adept and far more likely to become early adopters. As a result, the growth of digital is becoming a global endeavor, with developing markets playing a sizeable role in pushing the ball forward.

In light of this global trend, it is somewhat fitting that our latest event took place south of the border. Manatt Digital is an organization that prides itself on being in the mix for all happenings related to the exciting world of digital media. As part of this ongoing effort, our Managing Director Eunice Shin recently attended the “Mita Tech Talks” in Punta Mita, Mexico.

This annual event is a premier technology and venture capital event for Latin America, focused on providing a forum for cross-border opportunities and networking. During her time at the event, Eunice presented an overview of the evolving digital content market in Mexico. This presentation highlighted key findings from a recent thought leadership piece authored by Manatt Digital’s Jacob Carlson and was also presented during the event. We have featured an abridged version of this article below along with a link to the full version. We hope you enjoy our February newsletter!

L.A.’s Media and Commerce Tech Startup Ecosystem

By Mary Ermitanio

In January, Downtown Los Angeles hosted its first TechFair L.A., an event that brought together over 200 of the city’s hottest tech companies, including social platform Snap, Inc., virtual reality (VR) startup Two Bit Circus, AI company GumGum and SpaceX. In that same week, the 23rd Screen Actors Guild and the 28th Producers Guild Award ceremonies took place about ten miles west in Beverly Hills. L.A. has always been home to the best creative minds in Hollywood and, in recent years, is increasingly becoming a hub for tech and innovation across all industries.

The rise of digital video consumption and new experiences like augmented reality (AR) and VR requires increased collaboration between tech and content experts. L.A.’s diverse talent communities make its positioning for such convergence optimal. When YouTube’s platform democratized the production and distribution of video, the creative minds of L.A. spawned dozens of digital-first content companies—many of which have been acquired, including Fullscreen, AwesomenessTV, and Maker. L.A. is also poised to be a leader in emerging tech like AR and VR. L.A.-based Survios ($54M raised to date) developed the first VR game with revenues over $1M in one month. As Silicon Valley giants like Amazon and Facebook begin to look more and more like media companies, they increase their presence in L.A. and contribute to the city’s growing tech sector. According to L.A.’s Mayor Eric Garcetti, there are “more technology jobs in L.A. County than any county in America and we graduate more engineers than any other city.”

In addition to media, the e-commerce startup space has also seen significant growth in terms of M&A and investment activity. While not all e-commerce news in the last few years has been rosy, L.A.’s creative and trendsetting capabilities continue to build new brands and communities around those brands. Revolve Clothing has been able to leverage their network of influencers and has reportedly grossed almost half a billion dollars in 2015. Three-year-old Thrive Market raised $111 million, and five-year-old Dollar Shave Club’s was acquired by Unilever for $1 billion in 2016. Commerce companies also benefit from the proximity to the two busiest ports in the U.S.

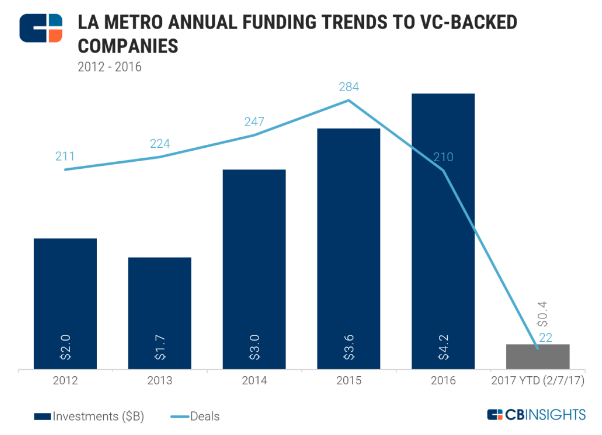

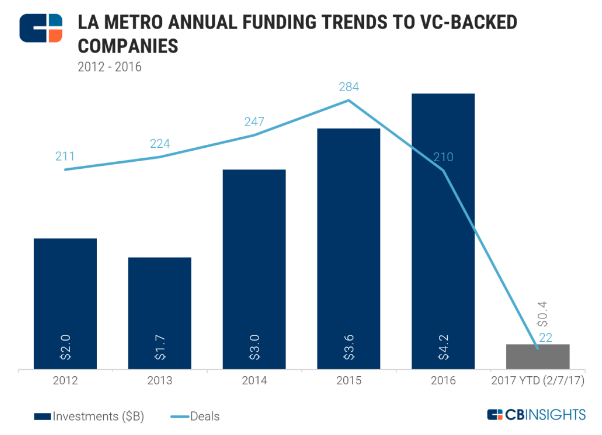

While total funding value in L.A. is still much smaller than in Silicon Valley, recent events, such as the acquisition of Riot and the impending Snap, Inc. IPO (with a $25 billion valuation goal) will spawn new investors and entrepreneurs that will continue to accelerate the growth of L.A.’s startup ecosystem.

The chart below from CB Insights shows investment activity in L.A..

Save the Date: Made in L.A. event on March 6, 2017

Entrepreneurship is a fundamental tool for engaging students in low-income communities and reversing the youth unemployment crisis. The Network for Teaching Entrepreneurship’s (NFTE) 4th annual Made in L.A. event is a celebration of entrepreneurship in Los Angeles. The event will showcase leaders from L.A.’s entrepreneur community whose successful ventures are Conquering the World from L.A.. Proceeds benefit the NFTE budding entrepreneurs and education programs in low income communities. Event details below:

Made in L.A.: Conquering the World from Los Angeles

Monday, March 6th at 7pm

Cross Campus, Santa Monica

Registration: https://make-in-la-2017.eventbrite.com

The Digital Content Market in Mexico

This is a condensed version of a more in-depth article, which can be found here.

Today’s global content market is constantly evolving. The rise of digital platforms has created new and exciting opportunities for production, distribution and consumption of content. Producers and distributors are meeting their audiences where they live, which is increasingly on digital platforms. This is no different in Mexico, where the content trends are shifting, albeit at a different pace than other countries. The Mexican market is poised for a significant uptick in digital content consumption, but there are three main growth dependencies that will affect how quickly and how high the ceiling will be in the shift to digital.

Mexico’s young population is demanding and driving a more mobile and digital focused economy as consumers continue to flock towards digital platforms for social media, messaging, and video on demand (VOD) and subscription video on demand (SVOD) services while still supporting the robust free-to-air and pay-TV market. The ability of Mexico’s large media companies to learn from other global markets and effectively execute digital transformation strategies will be essential to their survival. The digital ecosystem has become a global marketplace, creating opportunities for consolidation via M&A and strategic investment. Mexico may be in an attractive position to benefit from these activities with the right strategic development and growth plan.

Content Trends and Opportunities

While digital content is becoming more ubiquitous in Mexico, free-to-air TV is immensely popular, as almost one-third of all households have only free-to-air TV in the house. Televisa and TV Azteca have had a duopoly on the market for some time, with Televisa controlling about two-thirds of the market share to TV Azteca’s one-third. However, in an effort to increase competition, Imagen Television has joined the market as a third entrant at the end of 2016. The pay-TV market is still very strong in Mexico as well. With around 19.5 million subscribing households, that makes for a relatively low 60%+ penetration rate in the country, but a high raw number for Latin America, accounting for about one-quarter of the region’s pay-TV subscribers.

Over the Top (OTT) is picking up steam in Mexico, thanks in large part to Netflix’s presence. The OTT leader by far, Netflix has a 70% market share. However, they are no longer the only major player, as Televisa’s Blim has increased its market share from 1.5% in May 2016 to 17.5% by November 2016, knocking America Movil’s Claro Video to a distant third place. Reports have Netflix subscriber numbers pegged somewhere around five million users, which is well below pay-TV subscriber counts. However, the Mexican digital video industry grew 39% year over year in 2016, thanks to increased broadband penetration rates and smartphone adoption, while digital video revenue is projected to increase to $500 million by 2020. Both Netflix and Blim are continuing the global strategy of ramping up localized original content production to attract subscribers and stake claim to a large market share of Mexico’s OTT landscape.

Due to some of the growth dependencies in the SVOD OTT market, Mexico’s population is still going to other online platforms to consume content in a variety of ways. Social media, messenger apps and YouTube are all connecting with a large percentage of the population, providing an opportunity for content creators to reach audiences directly. Facebook is far and away the most popular destination for social media, as an estimated 51.8 million Mexicans use the site, accounting for almost 95% of the country’s social networking population. WhatsApp is the second most popular social destination, with approximately 79% usage, followed by YouTube at 66%. Mexico has the third highest YouTube consumption in the world, with over four billion video views per month, showing that it is focused on the future of digital video. Combined OTT and online video viewing time exceeds 14 hours per week, with the majority of that time spent on VOD content.

Mexico’s population skews young compared to many other countries around the world, and with that comes an increased propensity to consume and spend on media and entertainment. With over 60% of the population under the age of 35, Mexico has a prime demographic that is poised to drive digital content consumption. According to eMarketer, approximately “three-quarters of internet users in the country will use a social network via any device at least once per month.” This heavy usage creates opportunity for content creators and advertisers alike, strengthening the digital ecosystem even more.

Growth Dependencies

Broadband Internet

The growth of the digital distribution network in Mexico is reliant on the quality of its infrastructure which is poised for vast improvements. According to a recent SNL Kagan report, the Mexican government has been working on its Programa Nacional de Infraestructura 2014-2018, which includes an estimated $38 billion investment into the telecommunications sector. The México Conectado project is also tasked with providing free broadband internet access in public spaces. These developments will help increase the number of broadband users and allow for more consumption opportunities for digital content.3

Broadband penetration climbed to an estimated 45.5% of Mexican households by the end of 2016 and is projected to reach 54% of households by the end of 2020.4 That continued growth will be necessary to scale the potential digital market opportunity and create the type of user activity that can sustain a digital content ecosystem. One reason for Mexico’s lower broadband penetration rates overall is the consolidated power of America Movil and its subsidiary Telmex, which holds a roughly 60% market share for the country’s fixed broadband services.5 Until government action in 2013, broadband access was limited to those consumers who bought a more expensive package that included a landline. Increased competition from Megacable and izzi are opening up options for consumers, as well as providing broadband-only services.

Mobile Phones

The Mexican mobile phone market has become a rapidly growing internet entry point for users. While America Movil has significant market share (66%), Telefonica (20%) and AT&T (14%) are trying to gain ground. This increased competition has opened the wireless market up and consumers are taking advantage of it. As of 2016, Mexico has a 69% mobile phone penetration rate with projected growth to 84% by 2020. More than half of all mobile customers have a smartphone currently, which should increase to 70% by 2020, and two-thirds of the entire Mexican population should have mobile internet access by 2020. All of this growth should lead to more digital content consumption. The growth in the mobile market will continue to drive opportunities for digital platforms and distribution. Most internet users (68%) use their mobile phone to access the internet now.

Credit Cards and Alternative Payment Methods

One of the major limitations to OTT growth in Mexico is the lack of credit and debit card usage. For SVOD services such as Netflix, a valid credit card is the easiest way to pay for the recurring subscription fees. According to the latest Global Findex survey, credit card ownership and usage is extremely low in Mexico, registering less than half the cards per person than Brazil.6 Also, according to a PwC report, only 18% of the population has a credit card at all.

In order for SVOD services to gain traction, it will be necessary to increase the number of credit and debit card users. This is a big task for the Mexican financial institutions, as fraud and data theft are two major issues that consumers face when using their cards online. Netflix does offer alternative payment methods, such as prepaid gift cards, PayPal, and iTunes or Google Play integration for account payment consolidation. SVOD providers and other online content distributors will need to adopt and integrate these alternative payment methods to capture market share and scale operations.

Digital Transformation and M&A Opportunities

While some of the dependencies hindering Mexico’s digital growth opportunities are being addressed, the bigger players in the space have the luxury of creating and executing digital transformation strategies to position themselves for future market relevance and dominance. Companies like America Movil, Televisa, and TV Azteca are all in a position of risk and opportunity as Mexico continues to move into the digital age. Televisa is taking a strong, diversified approach while maintaining and growing its main revenue streams. Their continued approach to quality original content production has helped it solidify its own distribution channels, while providing significant content to Univision in the U.S. for additional revenue. On the other hand, TV Azteca has been slow to act. Their updated strategy to commit to new content production is potentially too little too late. Their lack of digital strategy and presence will hurt their position with millennials.

One of the ways in which these companies can position themselves for the future includes the same strategy that Televisa seems to be taking. The digital diversification of business models and commitment to the coming changes of content consumption behaviors is important. Investment in in-house growth opportunities or other strategic companies will mitigate risk for potential shifts in the ecosystem.

The opportunity for growth via international investment or acquisition can also help reduce risk. Since Mexico is already a leader in content production and distribution in Latin America, a natural growth strategy to expand influence and efficiencies across the region could bear fruit with a larger digital reach. Identifying and executing that strategy properly will require a deep knowledge of the digital landscape and future trends.

Conversely, Mexico can become a potential investment target for foreign entities looking to reach a digital growth market. The ability of Mexican companies to effectively communicate their strategy and growth plans against the realities of the marketplace can potentially attract an international investment opportunity. However, it is necessary to understand what a strategic investor would be looking for and how to position the company to be attractive for investment.

Conclusion

The future of digital content production and distribution in Mexico is bright. The current limiting dependencies in place are already being addressed in some way or another by government or private investment. With the rapid pace of technology development and the growing competitive landscape, including AT&T’s emergence as a legitimate wireless company and $3 billion USD investment, Mexico is poised to take advantage of the coming digital transformation. It will be important to continue to understand the evolving content trends within and outside of Mexico, but with the right strategy and execution plan, Mexican companies could be in position to thrive in the new digital age.

1SNL Kagan. “Global Multichannel Forecast Table—Mexico.” September 23, 2016.

2SNL Kagan. “Broadcast TV Summary—Mexico.” September 23, 2016.

3Mendez, Marcos Rodrigues. “In Mexico, broadband expansion won't eclipse pay TV.” SNL Kagan—Global Multichannel. December 30, 2015.

4SNL Kagan. “Global Multichannel Forecast Table—Mexico.” September 23, 2016.

5SNL Kagan. “Broadband Market Summary—Mexico.” September 23, 2016.

6Global Findex survey—Mexico. 2014.