Top Five Healthcare Antitrust Trends to Watch in 2017

By Lisl Dunlop, Partner, Antitrust and Competition

Antitrust enforcement and litigation had a big year in 2016. In this article, we look back at the most significant cases for the healthcare industry over the last year to identify key trends to watch for in 2017.

1. Provider Mergers

Expect to see the Federal Trade Commission (FTC) vigorously investigating and challenging provider mergers though 2017 and beyond. Last year was a roller-coaster ride for FTC merger enforcement in the healthcare field, with the agency first losing two preliminary injunction cases, and then having both decisions reversed on appeal. The FTC has emerged from these cases with its enforcement record and market definition theories intact.

The basic rubric that emerges from the FTC’s hospital merger cases is that: (1) hospital product markets are well established as “general acute care services;” (2) geographic markets are based on insurer requirements for creating saleable insurance products, rather than on historical patient movements; (3) a significant increase in market concentration in the market is presumed to adversely affect competition; and (4) courts will likely continue to be hostile to arguments that merger efficiencies outweigh the presumed competitive harm of substantial increases in market concentration. Absent highly competitive markets or compelling reasons to merge—such as a genuine “failing firm” situation—the FTC is likely to maintain a hard line against significant hospital merger transactions.

There is likely to be continued provider merger activity through 2017. The pressures that have led to provider consolidation over the last several years are not going away, and may even be heightened if the Affordable Care Act (ACA) is, in fact, repealed. Providers will continue to face the financial pressures of low, non-negotiable Medicare and Medicaid rates and uninsured care, and commercial insurers will continue to seek ways to lower costs through playing off competitive providers, network design and promotion of value-based contracting. Although collaborations short of merger may alleviate antitrust concerns, the investments and time required to achieve efficiency-creating integrations that permit collective negotiation and value-based contracting will still be challenging, and mergers remain the fastest and simplest way to achieve these goals.

2. Certificate of Public Advantage (COPA) Laws

In 2016, we saw the successful use of a state COPA law to shield a hospital merger from FTC attack. After the FTC challenged the proposed merger of West Virginia hospitals Cabell Huntington and St. Mary’s in late 2015, the state enacted a law subjecting certain transactions between teaching hospitals (such as Cabell Huntington) and other hospitals to review and authorization by the West Virginia Health Care Authority, removing the Cabell/St. Mary’s transaction from the reach of federal antitrust laws. In light of this, the FTC was forced to drop its challenge to the merger.

The FTC has been vociferous in its opposition to COPA laws, making numerous policy submissions to state legislatures and Departments of Health over the last few years. The FTC argues that COPA laws undervalue the important role of competition in the healthcare sector, and that placing healthcare providers under state regulatory authority to the exclusion of federal antitrust enforcement and judicial review permits anticompetitive activity. Proponents of the laws note that achievement of state healthcare policies often requires the consideration of broader concerns than competition. They reject the FTC’s contention that state review cannot adequately protect competition where it is desirable.

Several states now have various forms of COPA legislation, and providers are beginning to make use of it. The first COPA under New York’s law permitting collaboration by providers forming a performing provider system for coordination and delivery of healthcare services to Medicaid patients was granted to Staten Island Preferred Provider System (PPS) in December 2016. It is likely that there will continue to be activity in this area, as well as FTC opposition.

3. Pay-for-Delay Litigation

The pharmaceutical industry continues to be beset with suits surrounding so-called “reverse payment” or “pay for delay” patent settlements arising from patent litigation between branded and generic drug manufacturers. These cases arise from the Hatch-Waxman Act, under which generic companies submitting an abbreviated new drug application (ANDA) with the Food and Drug Administration (FDA) must certify that their drug will not infringe a patent (initiating patent litigation with the patent owner). If such certification is made, the first ANDA filer gains a valuable 180-day generic exclusivity period.

Earlier cases made clear that large reverse payments (money payments by the branded manufacturer to the generic manufacturer) in return for delaying market entry were antitrust violations. Since then, there have been fewer settlements involving clear reverse payments, and cases have focused on more ambiguous agreements.

In one case concerning Wellbutrin, for example, the settlement actually permitted the underlying patent dispute to continue and allowed the generic manufacturers to launch their products when they prevailed in the suit or by the end of May 2008. In other cases, agreements have been made about the branded manufacturer holding off on introducing an “authorized generic (AG)” during the exclusivity period, raising disputes about whether such an agreement is actually a “payment.”

The FTC also continues to keep a close eye on the industry, aided by legislation requiring drug companies to report all patent settlements between branded and generic drug manufacturers that relate to branded or generic drugs subject to an ANDA or the 180-day exclusivity period. Relatively few agreements reported to the FTC in 2015 contained significant cash settlements to the generic manufacturer, and the use of “no-AG” commitments also has declined.

4. Generic Drug Pricing Investigations

In November 2016, it was revealed that the Department of Justice (DOJ) Antitrust Division had been conducting a two-year investigation into collusion in generic drug pricing. While public and congressional attention had been focused on branded drugs earlier in 2016 (for example, Mylan’s pricing of the Epipen), the DOJ’s investigation is now bringing generic drugs into the fray. A large number of listed generic companies made disclosures about the inquiry, including Mylan, Teva, Actavis, Impax, Sun, Endo and Taro.

The DOJ’s investigation focuses on “hard-core” cartel conduct— price fixing, bid rigging and market allocation that attracts criminal antitrust charges. Such investigations typically yield large corporate fines, as well as jail terms for individuals involved. In past years, the DOJ has targeted companies in industries as diverse as auto parts, LCD screens, real estate foreclosure auctions, and ocean shipping, obtaining penalties of many millions of dollars from both U.S. and foreign companies, as well as prison terms for many executives.

In January 2017, the first charges were announced when two executives from Heritage Pharmaceuticals pleaded guilty to felony charges that they participated in a seven-year conspiracy to manipulate prices and divvy up customers for doxycycline hyclate, an antibiotic, and glyburide, a medicine used to treat diabetes. Around the same time, 20 states filed a civil suit against Heritage and other generic companies, including Mylan and Teva, relating to the same drugs.

It is typical for investigations like this to spawn additional investigations into other companies and other drugs, as companies under investigation seek to cooperate in return for more lenient treatment. The investigation also could extend to other parts of the pharmaceutical industry such as drug wholesalers and pharmacies.

5. Anti-Steering Rules

In 2016, the U.S. Court of Appeals, Second Circuit, reversed a win by the DOJ in its suit against American Express. The DOJ had alleged that non-discrimination provisions in AmEx’s merchant agreements violated antitrust laws. The non-discrimination provisions prevented merchants from encouraging consumers to use other credit cards that are cheaper for the merchant to accept. The district court had held that AmEx had market power in the credit card market and that the restrictions created an incentive for AmEx to charge higher prices without procompetitive benefits. The appeals court reversed, finding in particular that the lower court made an error in considering the impact of the rules only on one side of the market—the impact on merchants—rather than both sides, which would require considering the impact on both merchants and cardholders.

As in the retail credit card industry, in the healthcare industry insurers have an incentive to steer their insured consumers to the lowest-cost provider. This has led to innovations such as tiered and narrow networks and other mechanisms to incentivize patients to use particular providers with whom insurers have negotiated preferred rates. The DOJ and FTC have hailed these developments as procompetitive in that they promote price competition between different providers seeking preferred status in various plans, ultimately resulting in lower prices.

The DOJ is currently suing the Carolinas Healthcare System in North Carolina, alleging that the CHS used its dominant market position to impose provisions in its contracts with major health insurers preventing the insurers from using steering mechanisms. (See Steering and its Broad Implications for Payer-Hospital Negotiations). The DOJ alleges that by preventing steering Carolinas Healthcare has interfered with the competitive process and has been able to impose significant annual reimbursement rate increases as a result. CHS has argued that the AmEx decision undermines the legal arguments at the core of the DOJ’s case and has sought to dismiss the case. The Court’s decision is pending. The CHS case has important implications for the ability of providers to restrict insurers, and could lead to even broader adoption of tiering and steering in insurance products.

Conclusion

Many of the trends that made 2016 a banner year for antitrust litigation and enforcement are continuing and even strengthening in 2017. Provider mergers—and the market forces that drive them—remain strong. States continue to enact COPA legislation and providers are learning to use it. The FTC continues to increase its scrutiny of the pharmaceutical industry and the practices and pricing around generics. In addition, depending on its outcome, the CHS case could pave the way for potential increases in insurance product tiering and steering. All these signs point to 2017 as another significant year for antitrust, with the need to keep a close watch on pending and upcoming cases.

back to top

Regulatory Concerns Around Big Data, Artificial Intelligence and the IoT

By Richard Lawson, Partner, Consumer Protection

Data is everywhere. By some estimates, 90% of the world's data has been created in the last two years. This deluge is only going to intensify as the Internet of Things (IoT) is expected to add somewhere between 20 –50 billion connected devices.

If our current phase of the information revolution is marked by Big Data, then the next phase will be defined by the addition of Artificial Intelligence (AI). The only way the massive amounts of data being generated will be capable of being utilized will be through the power of AI. Data has long been the coin of the realm for modern businesses, but in this new era of AI combined with Big Data, the data a business collects will become virtually priceless. AI is expected to have a tremendous impact in the healthcare industry, and the opportunities offered by the confluence of these three trends—Big Data, AI and IoT—come tempered with regulatory concerns about data collection, use and security.

Brief Overview of Data and AI

The rapid advances in AI over the past few years are the result of advances in "neural nets" in computing. Data inputs—for example, images of human faces—are run through several levels of analysis. Multiple analyses are performed at each level. (The number of levels and the number of operations at each level can vary widely.) At each level and within each analysis performed at that level, each image is compared against a known master set of data, such as a storage bank of passport photos. If a query is made, for instance, asking if an image is male or female, at the conclusion of the analytical process, the computer gives its best guess about the image’s gender.

As you can see, data is critical in two regards. First, a master set of data is essential for the process to work. Second, the most powerful aspect of AI is its ability to learn. Accordingly, when it processes a picture of a girl and says it's a boy, a human can correct this. Then, the next time AI analyzes an image, it is much more likely to make a correct determination of the image’s sex.

This user-generated data is today, and will continue to be, immensely valuable. Unlike a commercially available master set of data, the data is proprietary to a specific company. Large amounts of data not only allow companies to offer better AI-powered services, but also to add to their bottom line assets.

Regulatory Concerns and the FTC’s Body of Privacy Law

If user data is key to the effective combination of Big Data and AI, then companies have to make sure that the data is collected properly. In the world of the IoT, this poses interesting challenges.

For example, how does a business provide a hyperlink to a privacy policy for the tracking chip placed in an aspirin bottle? The data collected on the use of that bottle could be helpful for sending a user a reminder to buy more and, combined with other data, to determine if a change in diet is needed or there is a more serious issue that necessitates a doctor's visit.

What's the regulatory regime at play here for maintaining this data? Is it the Health Insurance Portability and Accountability Act (HIPAA)? The Food and Drug Administration?

We’ve addressed HIPAA's scope extensively in previous articles. (See “Unleash Social Media’s Engagement Power While Protecting Consumer Privacy” and part 1 and part 2 of “The FTC and Patient Privacy.”) Many of the actors involved in healthcare marketing, however, such as data brokers, ad agencies, marketing clouds, and developers of health-related IoT devices, may not fall within its ambit. Accordingly, this raises issues as to the applicability of the Federal Trade Commission (FTC) Act and the FTC's body of privacy law, which in turn is relied upon extensively by the attorneys general (AGs) of all 50 states and the District of Columbia.

The bedrock of the FTC's privacy jurisdiction has centered on the notice and choice paradigm. When visiting a web site, for example, consumers are essentially deemed to have read and consented to the host site's privacy policy. Consumer awareness of the value of privacy and the use of their private data has been shown to be less than impressive, however.

For example, a 2015 survey by the University of Pennsylvania shows that 65% of consumers incorrectly believe that when a website has a privacy policy it means the company will not share their information with other websites and companies. The same study shows that most consumers are not aware of the privacy implications of companies selling data regarding food purchases and over-the- counter drugs. As data is going to be taking on value far beyond what we have previously seen, it will be essential for companies to gain consumer consent to obtain, use and share data with other businesses and successor companies.

For healthcare marketing, the FTC and state AG enforcement authority has long been established. The vast amounts of data that will be collected through IoT devices will allow for detailed consumer profiles to be created, as well as for specifically-timed marketing events when consumers are known to be at a certain location or conducting a specific online search.

Native advertising has been an effective marketing tool in the past few years. The key goal of native advertising is to present marketing material in a seamless, non-interruptive fashion within related content. The critical consumer protection issue is to ensure that the advertisement does not appear to be independent editorial content. In a healthcare setting, these concerns are manifestly apparent. It is critical to avoid the possibility that a consumer will take an action that is counterproductive to his or her health or recovery because of the mistaken perception that an advertisement is an objective article.

Key Takeaways from the FTC’s Report on Big Data

It is worth revisiting the FTC's report on Big Data from last January. In assessing Big Data, the FTC had four key takeaway issues:

- How representative is the data set?

- How does the data model account for biases?

- How accurate are the predictions from the data?

- How are ethical/fairness concerns addressed?

When we examine the AI process, we see that running inputs against data sets to determine accuracy raises easy-to-spot concerns for the healthcare industry. For example, the AI analysis needs to account for any relevant socio-economic biases in the input data being considered, as well as in the master data set.

The FTC’s Big Data report also referenced the potential uses of data in financial situations, such as through the Fair Credit Reporting Act. As applied in a healthcare context, any health-related information gathered from a consumer and otherwise lawfully shared (e.g., HIPAA exempt) with a financial institution which, due to the health habits of the consumer denies a loan or imposes a higher interest rate, could still bring legal complications.

Another twist is AARP’s recent lawsuit against the Equal Employment Opportunity Commission (EEOC) for offering a plan that allows employers to offer health insurance discounts to employees engaged in wellness plans. The AARP’s concern is that this penalizes employees who wish to keep their health data private.

Tension Increasing as AI, Big Data and the IoT Reach Maturity

In coming years, there will be considerable tension as AI, Big Data, and the IoT reach maturity. Years ago it was demonstrated that armed with only a birthdate, zip code and gender, the "anonymized" health data of then Governor William Weld of Massachusetts was correctly identified out of a pool of Massachusetts state employee data that had been released for research. With the power of AI, the challenge to effectively anonymize data will be that much greater.

Retention and purpose issues also will be a key concern. There have been multiple data breach cases that involve data that had not been used for over five years—or in some cases, had never been used at all. In addition to the time and expense of dealing with the regulatory agencies in such matters, the brand damage was considerable when the breach notifications went out to consumers who had not engaged with the businesses in years.

As detailed above, user data will be key for realizing the full potential of AI. Concerns about retention will have to be balanced against the astounding breakthroughs in healthcare delivery already underway. In mere seconds, AI can make diagnoses and suggest treatments based on a volume of medical research that no doctor could possibly have enough time to digest. Throw in the latest apps that allow consumers to provide their symptoms to an AI powered "nurse" and “doctor,” and the costs associated with medical “visits” can decline significantly.

This past summer the FTC issued a decision in the LabMD case which held that releasing sensitive health information alone— without any financial information—could qualify as harm under the FTC's unfairness standard. Rather than its usual enforcement workhorse, the deception standard—which focuses on misrepresentations by businesses—the FTC used the unfairness doctrine to hold LabMD liable for the negligent retention of sensitive medical data, absent statements or representations from LabMD to consumers explaining how that data would be maintained. This case is currently working its way through the courts and is one that has tremendous impact for IoT devices.

In aggregate, connected devices have the potential to paint extraordinarily detailed portraits of consumers. As sensitive as these portraits may be, their ability to have a tremendously beneficial impact on the course of healthcare is limitless. While there is much uncertainty as to what exactly the Trump administration will do, one phrase that has frequently appeared is "regulatory humility." This Administration and Congress will need to perform quite a balancing act between protecting consumer privacy and improving health and welfare through data-driven healthcare.

back to top

Now On Demand: What Does a Trump Administration Mean for Healthcare?

Click Here to View Manatt’s Recent Webinar Free on Demand, and Here to Download a Free Copy of the Presentation.

On January 12, Manatt Health presented a new webinar examining what the Republican sweep of the presidency, House and Senate—as well as its control of 33 governorships and 70 of 99 state legislative bodies—means for healthcare at the federal and state levels. The program provides a detailed look at what to expect from the new Trump administration.

If you or anyone on your team were unable to attend the session—or want to view it again—click here to access it free on demand. If you would like a free copy of the presentation for your continued reference, click here.

The webinar addresses a broad range of key issues:

- The Trump administration’s healthcare agenda and competing priorities

- The healthcare positions, goals and legislative/policy backgrounds of key appointees—and their potential impact

- Potential administrative and legislative actions in areas such as drug costs, Medicare, Medicaid, Marketplaces, reproductive health and employer coverage

- Policy options for “repeal and replace,” including the key components of a replacement strategy

- Key events coming up this year—from the expiration of CHIP to pending decisions on the insurance company mergers to cost-sharing reductions and risk-adjustment payments

Federal Insights: New Manatt Publication with Ongoing Updates

Manatt recently launched a new publication, Federal Insights, which is designed to provide concise and timely updates on key health reform developments as they occur at the federal and state level. If you would like more information or to subscribe, please contact Chiquita Brooks-LaSure, Managing Director, Manatt Health.

back to top

New Webinar: How Will the Trump Administration Impact Healthcare Litigation?

Donald Trump has vowed to eliminate the Affordable Care Act (ACA)—and the repeal and replace process has begun. The Senate has introduced reconciliation instructions that leave most ACA provisions with a budget impact on the table. The debate continues to rage. Whatever the outcome—whether an outright repeal or a partial rollback—significant changes would be triggered in existing healthcare law. How will healthcare litigation be affected? Manatt’s new webinar for Bloomberg BNA provides the answer.

The webinar begins with an analysis of the current state, setting the context with a detailed update on politics, policies and procedures. It then delves into how coming changes will affect healthcare litigation across a wide range of critical areas, from existing lawsuits around healthcare access and services to fraud and abuse litigation to federal vs. state regulation of health insurance. Key topics to be covered include:

- The Trump administration’s healthcare positions, policies and priorities—including what we’ve seen in the first weeks and what’s likely to come.

- The latest update on repeal and replace options, strategies and efforts.

- Potential legislative and administrative actions and their impact by type of market, as well as by stakeholder group.

- The impact of eliminating or rolling back the ACA on healthcare litigation.

- The ways that current lawsuits challenging denials of access to care will be affected by partial or complete repeal.

- How existing litigation around coverage of services—such as contraception and transgender surgeries—is likely to move forward under other federal and state laws.

- If and how repeal and replace would affect other key litigation areas, such as fraud and abuse and pharmaceutical litigation.

back to top

Exchange Plan Formulary Coverage Lower for Oncology Drugs Approved After 2000

By Annemarie Wouters, Senior Advisor, Manatt Health | Jessica Nysenbaum, Senior Manager, Manatt Health | Harsha Prabhala, Consultant, Manatt Health

On December 13, 2016, President Obama signed the 21st Century Cures Act. The Act includes several provisions intended to expedite the discovery, development and delivery of new treatments and cures. According to the Global Oncology Trend Report (June 2016) by QuintilesIMS, the pace of innovation in oncology treatments is significant with several cancers being treated with one or more of the 70 new cancer treatments launched within the past five years. To fully translate cancer therapies from the bench to the bedside, health insurance medical and drug benefit designs, including drug formularies, should ensure that the most appropriate treatments are available to the right patients at the right time.

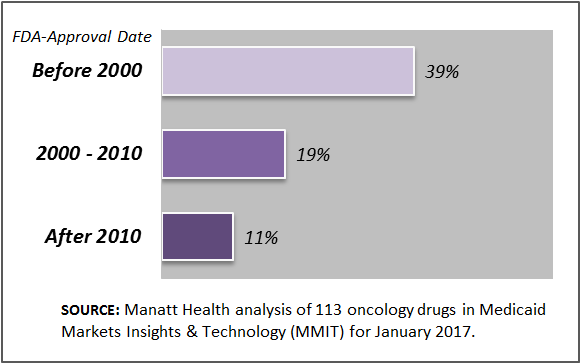

Manatt Health’s analytics team assessed formulary coverage of exchange plans in January 2017 using Managed Markets Insight & Technology (MMIT) data for 113 oncology drugs. Our analysis indicates that cancer drugs recently approved (for their first indication) by the Food and Drug Administration (FDA) are available on fewer exchange plan formularies than those approved in earlier years. (See chart below.) For example, on average, 39 percent of exchange plan formularies cover oncology drugs approved before 2000 compared to just 11 percent that cover oncology drugs approved since 2010. These results highlight the importance of accompanying provisions, such as those included in the 21st Century Cures Act, with initiatives around drug benefit designs and formularies to ensure patients have access to high-value medicines.

Exchange Plan Formulary Coverage of Oncology Drugs by FDA-Approval Date, January 2017

NOTE: The percentages displayed represent the average of the individual drug’s percent coverage under Exchange plan formularies for the oncology drugs approved during that time period.

back to top

Reviewing Entry Points Into Maryland’s Health and Social Service Programs

By Jocelyn Guyer, Managing Director, Manatt Health | Allison Garcimonde, Manager, Manatt Health | Adam Striar, Consultant, Manatt Health

Editor’s Note: In a new legislatively-mandated report for the Hilltop Institute at the University of Maryland at Baltimore County, Manatt Health:

- Presents an overview of current entry points into health and human services in Maryland, focusing primarily on Medicaid and Marketplace coverage;

- Describes promising approaches that other states are adopting to provide efficient, coordinated access to health coverage and social service programs; and

- Offers recommendations for improving access to health coverage programs in Maryland and for reducing inefficiencies.

The article below summarizes key findings and highlights. Click here to download a free copy of the full report.

____________________________________

Inventory of Current Entry Points

Maryland residents can apply for health coverage and social service programs through a broad number of “entry points,” including through online websites operated by the Maryland Health Benefit Exchange (MHBE) and Department of Human Resources (DHR); by contacting a call center; or by receiving assistance from local health department staff, local department of social services staff, navigators, certified applications counselors, hospitals or insurance brokers. The wide array of entry points gives consumers many different opportunities to apply for and renew coverage, and allows them to select an approach consistent with their personal circumstances and needs.

While these efforts contribute to a smoother enrollment experience for Maryland consumers, at the same time, Maryland families still often must work with multiple entry points, if they happen to have members who qualify for coverage on different grounds or require both healthcare and social services. This imposes an administrative burden on Maryland residents and, as importantly, may result in the state expending unnecessary resources to gather and verify information on multiple occasions from the same applicant.

Best Practices

As in Maryland, states around the country are taking a new look at how best to improve and coordinate enrollment into health and social service programs. To identify best practices, we drew on published literature, as well as interviews with officials in Colorado, Idaho, New York and Michigan to identify best practices. The best practices identified include:

1. Fundamental organizational and cultural change

- Establish unified oversight of health and social service programs and a consolidated eligibility and enrollment system.

- Pursue a paradigm shift away from program-to-program eligibility determinations to a consumer-centric approach.

- In a unified system, preserve consumers’ right to choose elected health and social service programs.

2. Alignment of policies across programs

- Align definitions and requirements across programs.

- Establish automatic linkages in eligibility between health and social service programs.

- Align the timing of renewals or automatic renewals across programs.

3. Improvement of business processes

- Empower eligibility workers to provide same day, “end-to-end” service.

- Establish protocols that facilitate coordinated handoffs across programs.

4. Integration of IT systems

- Implement an integrated eligibility system.

- Implement a shared platform to reduce duplications and streamline eligibility and enrollment processes across programs.

- Consider more discrete IT tools to create efficiencies across programs.

5. Data analytics to drive performance improvement

- Collect and analyze program data for continuous improvement.

Recommendations

Based on the analysis of Maryland entry points and emerging best practices in other states, the report identifies a series of recommendations for further improving the efficiency and effectiveness of entry points to Maryland’s health coverage programs. Some of the recommended efforts already are under active consideration or slated to occur, while others may require a significantly longer timeline for implementation.

1. Establish a task force on coordination of health and social service programs.

The task force should be dedicated to sustaining and strengthening cross-agency collaboration on improving coordination across health and social service programs. It should build on and leverage existing coordination efforts and should be led out of the governor’s office to facilitate cross-agency participation.

2. Establish key performance metrics on access to health and social service programs and provide for public reporting.

The metrics should include basic data on applications, renewals and use of various entry points for health and social service programs, as well as measures that capture the effectiveness of coordination across programs.

3. Establish a seamless approach to evaluating an individual for all forms of Medicaid eligibility (i.e., both Modified Adjusted Gross Income (MAGI) and non-MAGI Medicaid).

Maryland should work toward a seamless eligibility and enrollment experience for individuals seeking both MAGI and non-MAGI Medicaid, minimizing the need for handoffs between systems and consumer assistance workers.

4. Create a data platform to facilitate data exchange between health and social service programs.

The state should pursue a shared data platform that can facilitate information sharing across health and social service programs.

5. Create an automatic eligibility linkage between Temporary Assistance for Needy Families (TANF)/Supplemental Nutrition Assistance Program (SNAP) and Medicaid.

Use the option available under federal law to automatically provide Medicaid to TANF and selected SNAP recipients, eliminating the need for them to undergo a separate determination of eligibility for health coverage.

6. Review the role of eligibility workers and other assisters to provide a seamless experience to consumers.

Conduct an assessment of the role of navigators and eligibility workers in all agencies to determine if their responsibilities could be modified or expanded to provide consumers with a more seamless experience that allows them to apply for coverage, receive an eligibility determination, and enroll in a specific plan during a single session.

7. Provide Medicaid beneficiaries with the ability to select a Medicaid managed care plan through the Maryland Health Connection (MHC).

Implement plans to modify MHC to allow consumers found eligible for Medicaid to select their managed care plan, eliminating an unnecessary delay in the initiation of managed coverage.

8. Systematically build referrals and “warm handoffs” between the Department of Human Resources, the Maryland Health Benefit Exchange and the Department of Health and Mental Hygiene.

Conduct a review of how to improve handoffs when consumers must be referred to a different agency, systematically identifying when and how such referrals should be conducted.

9. Establish unified back-end systems for customer relationship management and documentation storage for health coverage programs.

Establish a single, unified customer relationship management system for health coverage programs that can be used by navigators, call center staff, local health departments, and local departments of social services, so they can provide coordinated services to consumers. In addition, establish a unified system for storing documentation and other eligibility information for health programs.

Conclusion

Maryland has established a strong platform from which to continue to improve health and social service programs. It is clear, however, that more could be done to improve the entry points, creating a more efficient and consumer-friendly way to enroll people in coverage and social service programs.

As they proceed policymakers will need to be mindful of the potential for shifts in the federal government’s willingness to finance eligibility and enrollment systems and other changes given the priorities of the new Trump administration and Congress. Even so, Maryland should be able to continue making significant strides in efficiently providing consumers with access to health and social service programs, drawing on best practices from other states and its own rich history and experience.

back to top

“Connecting Medicaid Beneficiaries to Social Supports”: Questions Answered

Click Here to View the Webinar Free, On Demand—and Here to Download a Free PDF of the Presentation.

Editor’s Note: On December 7, Manatt Health and the Anthem Public Policy Institute co-hosted a new webinar examining the growing role of Medicaid managed care in addressing the social and economic challenges affecting health outcomes for patients with a mental health and/or substance use disorder (MH/SUD) diagnosis. We had so many excellent questions during the program that there wasn’t time to address them all. Below are a few that were asked by multiple participants along with the responses from our presenters.

If you or anyone on your team couldn’t participate in the session—or want to view it again—click here to access it free on demand. If you would like to download a free copy of the presentation for your continued reference, click here.

____________________________________

Question 1: How does payment work for social support connections?

Answer 1: In the past, TennCare had a mental health case management benefit which was focused on linkage to other services. This was a reimbursable service. However, there were no outcomes measures. TennCare has just implemented a Serious Mental Illness (SMI) model, focusing on care coordination, with quality metrics. The quality metrics will be reported and measured against standards. Health Home providers are paid on a case rate when a Health Home activity is rendered.

Question 2: Who pays for room and board services?

Answer 2: Room and board are usually covered by the member’s Social Security Income (SSI) check.

Question 3: How many dedicated case managers do the Managed Care Organizations (MCOs) have for social support connecting?

Answer 3: TennCare does not prescribe a set number of staff for MCO case managers, but they must have staffing to fulfill the population health requirements for outreach and care coordination at the MCO level.

Question 4: What tools are used to assess social needs? Are the tools the same for children and adults?

Answer 4: The Bureau of TennCare does not prescribe a tool and there isn't a statewide tool that is adopted by all providers. Some agencies use the Daily Living Activities (DLA-20) Functional Assessment, Child and Adolescent Needs and Strengths (CANS), Adult Needs and Strengths Assessment (ANSA) or home-grown tools. All of our providers use some type of tool.

Question 5: Is 42 CFR Part 2 (Patient Record Confidentiality Regulations) a barrier to sharing information between providers and MCOs in the TennCare program?

Answer 5: No, it is not a barrier. Our MCOs have individual professional contracts with behavioral health providers. All information is transmitted securely.

New White Paper Available

The webinar was based on a new white paper from the Anthem Public Policy Institute that explores the importance of Medicaid managed care in providing social supports to MH/SUD patients. The white paper is part of an Anthem Public Policy Institute series that looks at the approaches to and benefits of integrating physical health, mental health and substance use disorder benefits, as well as related areas of managed care innovation. To access the full white paper series, click here.

Webinar Presenters

Jon Glaudemans, Managing Director, Manatt Health

Jana Dreyzehner, MD, Behavioral Health Medical Director, Amerigroup, TN

Merrill Friedman, Senior Director for Disability Policy Engagement, Anthem, Inc.

Mary Shelton, Director, Behavioral Health Operations Bureau of TennCare

back to top