Added to federal tax law by the 2020 Coronavirus Aid, Relief, and Economic Security Act (CARES Act) and further expanded in 2021, the Employee Retention C redit (ERC) can significantly reduce an employer’s federal employment (payroll) taxes. In addition, ERC generates cash refunds to the extent the ERC exceeds the payroll taxes that were due in the applicable payroll period. Business owners now have 16 more months to amend their 2020 and 2021 payroll tax returns to recognize the ERC.

What Is the Employee Retention Credit?

Employers can use the ERC to offset dollar-for-dollar employer payroll taxes they otherwise must deposit with the IRS. The ERC can offset the employer share of Social Security taxes on wages consisting of 6.2% Old-Age, Survivors and Disability Insurance (OASDI) and 1.45% Hospital Insurance, a potential savings totaling 7.65% of tax otherwise payable. The credit does not affect the employee’s share of required Social Security taxes.

The ERC is “refundable,” meaning that if the available credit exceeds the employer’s liability for eligible payroll taxes, then the credit creates an overpayment for which the employer can obtain a refund from the IRS.

Credit Percentages

The ERC applies to:

- 50% of the qualified wages an eligible employer pays to employees after March 12, 2020, and before January 1, 2021;

- 70% of qualified wages from January 1, 2021, and before January 1, 2022

Potential Benefit

For 2020: Up to $10,000 per employee can be counted to determine the amount of the 50% ERC. The ERC is capped at $5,000 for all qualified wages paid between March 13, 2020, and December 31, 2020, to each employee for all calendar quarters in 2020.

For 2021: Eligible employers can claim the ERC against the employer share of Social Security tax equal to 70% of the qualified wages they paid to employees after December 31, 2020, and before January 1, 2022. Qualified wages are limited to $10,000 per employee per calendar quarter in 2021. The maximum ERC amount available is $7,000 per employee per calendar quarter, for a total of $28,000 per employee in 2021.

Does Your Business Qualify?

Employers can qualify for the ERC under any of three tests:

- the “gross receipts” test;

- the “suspension” test; or

- the “recovery startup business” test.

These tests apply separately to each calendar quarter, meaning that an employer may qualify to take the ERC for some quarters, though not necessarily all quarters in 2020 and 2021.

Gross Receipts Test

The “gross receipts” test is met by employers that have experienced a greater than 50% reduction in quarterly receipts, measured on a year-to-year comparison between 2019 and 2020, or that have experienced a greater than 20% reduction in quarterly receipts between 2019 and 2021.

Suspension Test

Determining eligibility under the “suspension” test proves less clear-cut than under the gross receipts test. Under the “suspension” test, employers must demonstrate their business operations were partially or fully suspended due to COVID-19 government shutdowns.

Businesses must demonstrate under the facts and circumstances that their operations were effectively suspended due to an inability to obtain critical goods from suppliers that were shut down, or that their hours of operation were reduced due to a governmental order. It is unclear what constitutes “operations” for businesses that remained partially operational during a shutdown. Other factors include the employer’s telework capabilities, portability of the employees’ work and the need for presence in an employee’s physical work space.

Essential businesses most likely will not qualify under the “suspension” test. The answers to these questions will become known only as the IRS possibly issues additional legal guidance on the ERC or examines employer payroll tax returns claiming the ERC.

Recovery Startup Business Test

Employers that started conducting business after February 15, 2020, can take the ERC if their average annual gross receipts did not exceed $1 million for the three tax years ending with the tax year preceding the calendar quarter for which the employer seeks to take the credit. These employers are eligible even if they do not satisfy either the gross receipts test or the suspension test.

Example

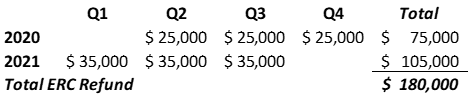

Assume XYZ Company has 35 employees in 2020 and 2021 and qualifies under the “gross receipts test” for the ERC in Q2 through Q4 in 2020 and Q1 through Q3 in 2021. Also assume that XYZ Company paid $50,000 in “qualified wages” per quarter in total and no employee earned more than $2,000 in qualified wages per quarter. XYZ Company will amend its payroll tax returns to claim the following ERCs, which will be refunded in cash:

Legal Authorities

See Internal Revenue Code Section 3134, added by the CARES Act, as amended by the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (Relief Act), the Consolidated Appropriations Act, 2021 (CAA 2021 ), and the American Rescue Plan of 2021 (ARPA).

How We Can Help

Manatt can help businesses determine if they qualify for the ERC by identifying and evaluating the key determinative factors. In addition, our tax attorneys can provide a legal opinion, when appropriate, to insulate employers from any interest and penalty charges that result from the IRS challenging ERC qualification. Our services provide a cost-efficient way for employers to determine ERC qualification and at the same time mitigate the risk of IRS assessment.

To learn more about qualifying for the ERC and our tax opinion letter services, contact the author of this alert or visit our Tax Practice page to find an attorney in your area. You can also visit our COVID-19: Tax Implications Practice page for additional alerts on this topic.